Wall Street was a very entertaining film about a man named Bud Fox who works on wall street. In the movie, Bud gets into business with an interesting character named Gekko, and he begins passing along insider trading tips. This partnership, along with some other poor decisions, lands Bud in hot water and leaves him reeling to save his Dad's business and his life. While insider trading was the main focus of the movie and was highly engaging, the focus of this paper will be on the sale of Bluestar Airlines, and the effect of consumer speculation on price in general.

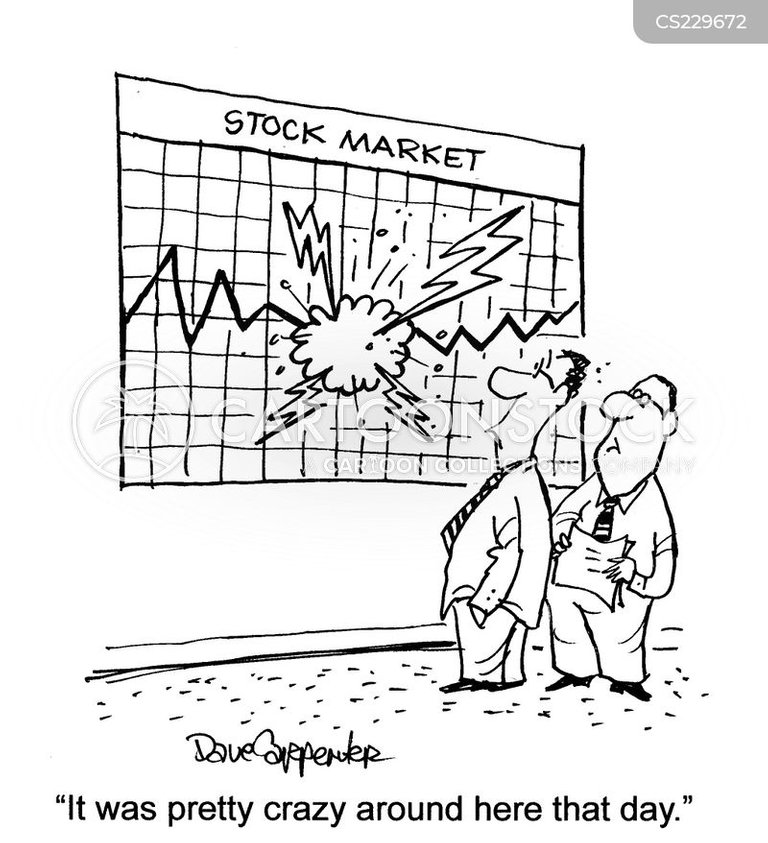

In the movie, to avoid Bluestar Airlines (Bud's dad's (Carl Fox) business) being liquidated by Gekko, Bud hatches a plan to leak information to the press that will make the stock price plummet to the ground, forcing Gekko to sell the company for a loss and leaving it open to be bought by Lawrence Wildman, who was working with Bud all along. This is fascinating in the movie because the company Bluestar Airlines did not actually change anything at all, the stock price simply dropped due to consumer speculation on the company being volatile.

This is the case with many real-life stocks as well. In January 2021, Gamestop was short-squeezed by getting people to invest frantically. The more people that invested, the more it went up, causing more people to invest, causing short sellers to liquidate their positions, causing the price to go up, and so on. Hedge funds lost billions of dollars in just a few months, and retail investors made millions. Meanwhile, Gamestop themselves had not changed a single thing about their company. In fact, at the time, they had been failing and downsizing for years. There was absolutely no logical reason to invest in Gamestop other than the fact that it had been shooting up in price. This is the power of speculation in the stock market.

But it is not just the stock market, prices are made by consumers in the real world too. Even at your local Walmart, prices are not set by the sellers, but by the buyers. At the end of the day, price is driven by demand, not supply. If tons of people are buying up the toilet paper, then stores can increase the price of toilet paper. If no one wants any hotdogs, then stores must decrease the price of hotdogs in order to get them off the shelves. Price can not be manipulated by sellers, it can't be cheated, they simply must adapt or die. This was explained to us many chapters/ units ago, so it is exciting to see the subject revisited via the movie Wall Street.

It does not matter whether it is the stock market, Walmart, or your local lemonade stand, prices are driven by the demand and speculation of the average consumer writ large. This is why the free market is so beautiful, and why it produces better results when unhampered. People are allowed to demand what they want, and in turn, other people will supply it, with price being a product of demand, not the other way around.

Works Cited

BYLUND, PER L. Seen, the Unseen, and the Unrealized: How Regulations Affect Our Everyday Lives. LEXINGTON Books, 2018.

Stone, Oliver, director. Wall Street. Twentieth Century Fox Film Corporation, 1987.

Image

Image Link